If you’re planning to engage in international trade, obtaining an import/export license in Sri Lanka is essential. This license allows you to legally trade goods across borders and ensures you comply with government regulations. Let’s break down the steps you need to follow to get your import/export license.

1. Understand the Importance of the License

Before you start the process, understand why the import/export license matters. It:

- Grants you the legal right to trade internationally.

- Helps streamline customs clearance.

- Ensures compliance with Sri Lankan laws and international trade agreements.

Without this license, you risk penalties, delays, or even confiscation of your goods.

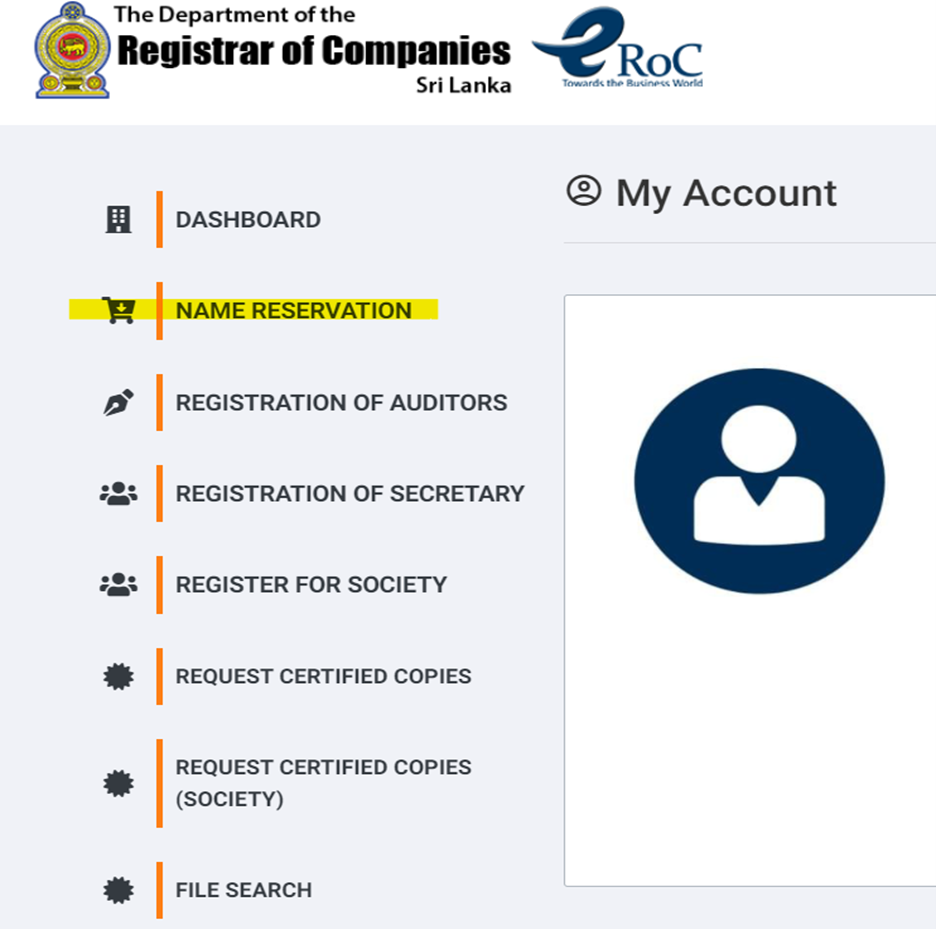

2. Register Your Business

To obtain an import/export license, you need a registered business in Sri Lanka. If you haven’t done so yet:

- Register your business name with the Registrar of Companies.

- Obtain a Business Registration Certificate (BRC) from the local authority.

Having a registered business establishes your legitimacy in international trade.

3. Apply for a Taxpayer Identification Number (TIN)

Visit the Inland Revenue Department (IRD) and apply for a Taxpayer Identification Number (TIN). You’ll need this for all tax-related transactions, including import/export activities.

4. Register with the Department of Imports and Exports

The next step involves registering with the Department of Imports and Exports Control. Follow these steps:

- Visit their official website or office to obtain the application form.

- Fill out the form with accurate details about your business and the nature of goods you plan to trade.

- Submit required documents, including your business registration and TIN certificate.

Website URL:

https://www.pubad.gov.lk

info@pubad.gov.lk

Contact Number:

+94 11 269 6211-13

Fax Number:

+94 11 269 5279

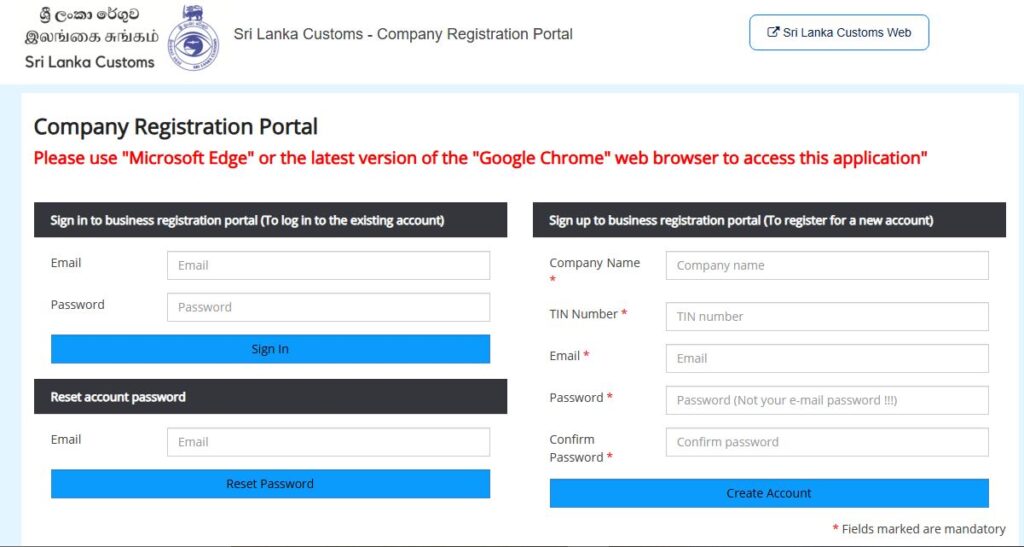

5. Obtain a Customs Registration (TIEP)

You also need to register with the Sri Lanka Customs Department under the Temporary Import for Export Purposes (TIEP) scheme. This ensures that your goods comply with customs regulations. To register:

- Submit your completed application form to the Customs Department.

- Provide necessary documents such as your business registration and proof of compliance with trade regulations.

6. Pay the Relevant Fees

Both the Department of Imports and Exports and the Customs Department require fees for processing your applications. Make sure you pay these fees promptly to avoid delays in your license approval.

7. Secure Additional Permits (if needed)

Depending on the type of goods you plan to import or export, you may need additional permits. For example:

- Agricultural Products: Permits from the Department of Agriculture.

- Pharmaceuticals: Approval from the National Medicines Regulatory Authority.

- Electronics or Chemicals: Special clearances from the relevant authorities.

8. Comply with Sri Lanka Customs Procedures

Once you have your license, follow Sri Lanka Customs procedures for every shipment:

- Submit the required import/export declarations.

- Pay applicable duties and taxes.

- Ensure your goods comply with safety and quality standards.

9. Stay Updated on Trade Policies

International trade laws and Sri Lanka’s regulations can change frequently. Keep yourself updated by following the Department of Imports and Exports Control and Sri Lanka Customs announcements. Staying informed ensures that your business avoids fines and stays competitive.

Conclusion

Obtaining an import/export license in Sri Lanka is a straightforward process if you follow the right steps. By registering your business, obtaining the necessary approvals, and adhering to customs regulations, you can seamlessly engage in international trade. Take the time to understand the requirements and invest in compliance to build a successful trading business.