As an employer in Sri Lanka, it is essential to understand your obligations regarding Employees’ Provident Fund (EPF) and Employees’ Trust Fund (ETF) contributions. These statutory payments play a vital role in securing employees’ financial futures while ensuring compliance with labor laws.

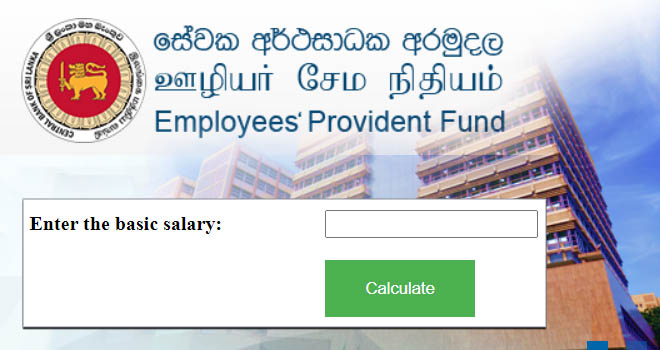

EPF/ETF Calculator

What is EPF and ETF?

- Employees' Provident Fund (EPF):

- A retirement savings scheme where both employers and employees contribute monthly.

- Managed by the Central Bank of Sri Lanka under the supervision of the Department of Labour.

- Employees' Trust Fund (ETF):

- A separate fund established to provide financial benefits to employees during employment and at retirement.

- Administered by the Employees’ Trust Fund Board.

EPF Contributions

- Employer Contribution: 12% of the employee's gross monthly earnings.

- Employee Contribution: 8% of the gross monthly earnings.

- Employers are responsible for deducting the employee’s share and remitting the total 20% (12% employer + 8% employee) to the EPF account.

Key Components of Gross Monthly Earnings:

- Basic salary.

- Cost of living allowances.

- Incentives, overtime, and bonuses.

ETF Contributions

- Employers contribute 3% of the employee's gross monthly earnings to the ETF.

- No contribution is required from employees.

Steps for Employers to Comply with EPF/ETF Requirements

1. Register with the EPF and ETF Authorities

- Employers must register with the EPF Department at the Central Bank of Sri Lanka.

- For ETF, register with the Employees’ Trust Fund Board.

2. Deduct and Calculate Contributions

- Deduct 8% of the gross salary from employees for EPF.

- Add the employer’s 12% for EPF and 3% for ETF.

3. Submit Monthly Contributions

- Contributions must be submitted monthly to the relevant authorities.

- Use the specified forms provided by the Department of Labour and ETF Board.

4. Maintain Accurate Records

- Keep detailed records of employee salaries, deductions, and remitted contributions.

- Records should include employee EPF/ETF account numbers for verification.

5. Provide Employee Details

- Furnish details such as employee names, NIC numbers, and gross earnings when submitting contributions.

Benefits for Employees

- EPF Benefits:

- Lump-sum payout upon retirement, migration, or permanent disability.

- Access to funds for housing or medical emergencies under specified conditions.

- ETF Benefits:

- Additional financial support at retirement or termination.

- Employees can also claim benefits for medical treatments or educational purposes.

Penalties for Non-Compliance

Employers who fail to make timely contributions may face:

- Monetary penalties and fines.

- Legal action under the Employees' Provident Fund Act and Employees' Trust Fund Act.

Conclusion

Understanding and adhering to EPF and ETF contribution requirements are critical for employers in Sri Lanka. By complying with these obligations, you not only avoid legal complications but also contribute to your employees’ financial security and well-being.